As a Vault Manager on Velvet Capital you can charge fees directly in your vault. The fees you can set are Management, Performance, Entry, and Exit.

Enabling institutional adoption of defi

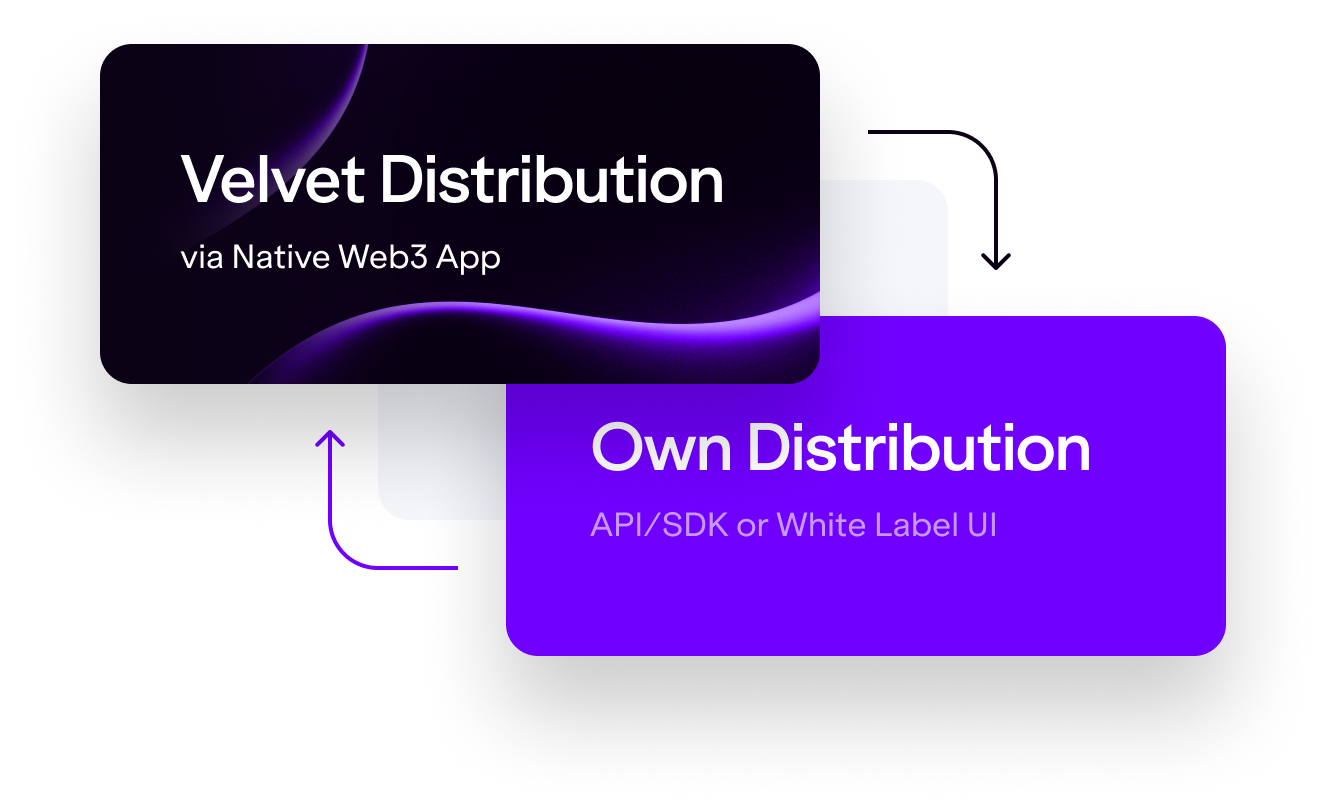

DeFi-as-a-Service for

Launch & manage on-chain funds,

structured products & DeFi strategies

Backed by

Backed by